Introducing SERO 2.0- The Rise and Vision-Part 3

Chun Xiao (Dawn of Spring)

In this last part of the series we will discuss why and how SERO 2.0 Consensus (Dawn of Spring) optimizes away some of the key potential problems in SERO’s ecological development which are addressed in the previous series.

Tokens in Ecological Smart Contract (Dapp) accounts will be able to participate in PoS mining.

Nowadays, most of the PoS mining mechanisms have become synonymous to generating income/interest by holding onto a stake position, but it doesn’t make total sense. If PoS mechanism can be regarded as equity share voting mechanism, then you as a shareholder have an obligation to participate in the governance of the company, whereby creating value. As the company’s valuation increases, so does the value of your equity shares. If your ownership has already assured the appreciation of your asset, why should additional incentives be awarded to you?

PoW miners, by contrast, are different in that they incur production cost in the form of mining machines and electricity, so they are more like employees than shareholders, so it is reasonable to use tokens as a miner’s reward.

We did see all the issues surrounding traditional PoS mechanism before it is launched, but unfortunately, it’s not until recently that we’ve been able to complement this logic with our new release of SERO 2.0 Consensus. Our resolution is based on the firm belief that if there is no Dapp for a utility network, then all discussions around valuations of public blockchain ecosystem are false propositions, so the focus should be on Dapp itself. In fact, we should emphasize and stimulate the practical utility value of each SERO token beyond investment and payment, and the best and simplest of judging whether a token has played its practical role is whether it is held in a general account or pledged in a smart contract account.

We know that when a token is pledged in a contract account, the contract creator or maintainer is not the owner of the token. The real owner transfers the token into the contract to satisfy some sort of actual demand relevant to that Dapp. If the PoS mining pool container was a contract, it would be a good example. We can give the following more generic example: if there is a decentralized auction Dapp that requires that all participants in the auction pledge a number of tokens into the contract, so that they can be eligible to participate the auction, or as a measure of asset guarantee, then the token owners making the pledge via the auction Dapp are actually the users of the contract, not the creators.

We can see allowing Dapp contracts participate in the PoS mining encourages the ecological builder to pool tokens under the contracts to get reward, which is justifiable and sensible. In the above case, the contract creator constructs a decentralized auction application on the public blockchain, thus creating a practical utility of the tokens. While he developed his own ecology within his business application, he inevitably enriches and expands the macro ecosystem of the public blockchain. In fact, he can divert some of the income generated by this type of PoS mining to further incentivize the users in his application. The positive feedback loop continues.

In order to do this, i.e. allowing tokens in smart contracts to participate in mining, we need to optimize SERO’s underlying consensus to build in some mechanisms to facilitate the contract creator, such as setting up rules of how to regulate tokens under the contract to participate in PoS mining, which staking node to join, participation ratio, account limitations, etc., which will be part of the contract code and will be known to all contract users in advance.

We have every reason to believe that smart contract’s account participation in PoS mining is a huge reform of the existing PoS consensus, and also a great incentive mechanism aimed at launching more Dapps on our macro ecology, encouraging more developers to take part in the construction of their own application specific ecological smart contracts. All of which will boost SERO token’s utility value in a long run, in our firm view.

Adjust the future output of SERO tokens to prevent excessive inflation from negatively affecting the stability of SERO economy, based on the analysis of supply & demand structure of the macro ecology in the future.

In the SERO public blockchain ecology, hundreds of tokens and DAPP have been developed, some of which have shown good development trends. It also can be seen that some potential, more practical developments are paving the way leading to more utilization of SERO token. Compared to when we made our original forecast, presently we can make more accurate measurements of the ecological demands in SERO tokens in the farther future, so we are obliged to effectively adjust the supply accordingly, in an attempt to make a more favorable environment for ecological development.

The main factors to be considered here includes the market demand driving the practical usage of SERO, the current market circulation, the potential supply & demand trend, and the relationship between the existing incentives and network security after the change taking place. We will discuss in depth about these factors in another article.

SERO Tokens will reveal more utility properties in the ecosystem.

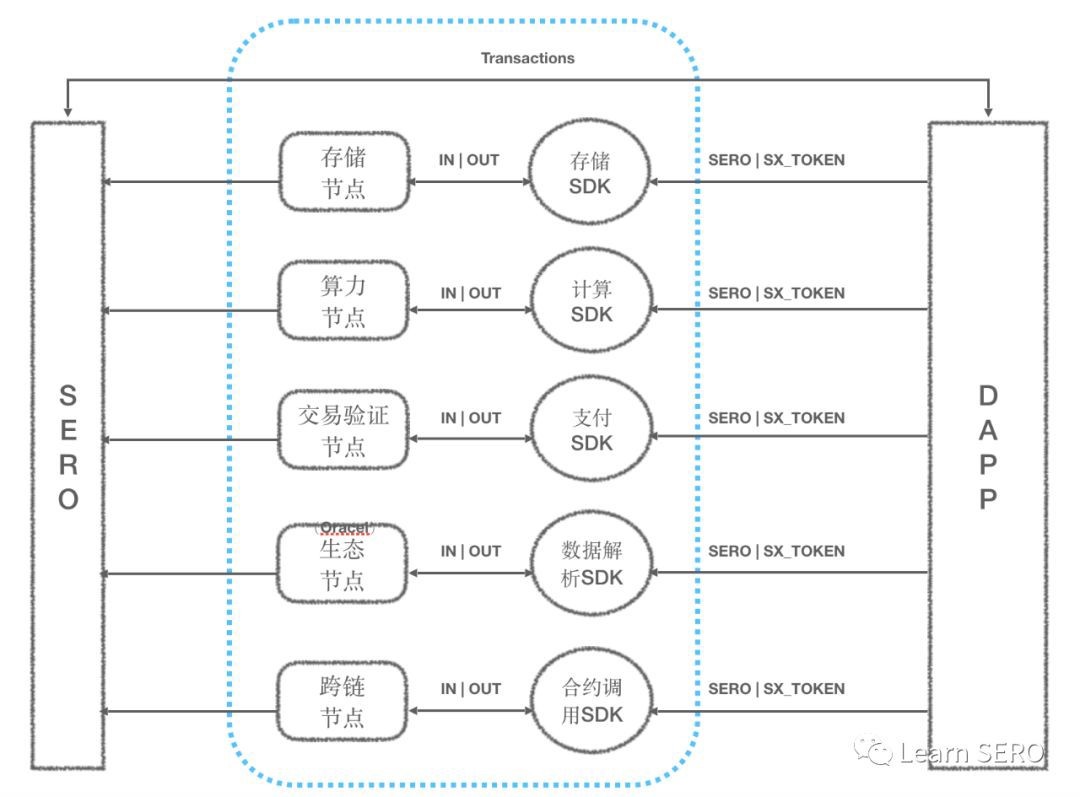

Let us first examine how the ecological Dapps of SERO interacts with the underlying public blockchain from this figure when some more powerful network services are needed.

We can see that the SERO public blockchain will provide more service mechanisms at the bottom layer of the network, giving Dapps more powerful functions, including larger storage space, network computing power, fast transaction verification channels, oracle machines, and cross-chain facilities. Most of them will be implemented by special nodes, and in fact, the previous staking nodes can be counted as a type of special nodes among them, so it is an easy comparison to make. When these nodes need network services, the network will require token pledges to ensure the reliability of future services; and when Dapps fail there will be corresponding penalty mechanism. Similarly, it can be required that Dapps pay tokens to the nodes when these network services are used.

Make the staking gains of the Ecological Prosperity Descriptor (the pledged SERO tokens) transparent.

These optimizations have only two ends, first to realize more practical value of SERO tokens and even their asset value (e.g., asset endorsement in the Stable Coin applications), and secondly to strike a good balance of various sources of demand & supply of the tokens throughout the SERO public block chain ecology.

In order to provide better governance services for the macro SERO ecosystem and localized sub ecological clusters, we will devote effort to construct certain contracts related to the ecological governance of token activity dynamics, monitoring and analyzing the usage, output, and circulation of tokens across the entire SERO network in real time, thus helping Dapp managers obtain more information for their decision making.

The Upgrade Plan

We plan to complete the final evolution of this Consensus in three phases:

Phase I (2020.2): Make the emission of SERO tokens in line with the needs of ecological development;

Phase II (2020.3): Enable ecological contract-locked SERO tokens to participate in PoS mining;

Phase III (2020.8): Increase the functionality of network services and make some requirement for contracts to use these services, including provisions to require the consumption and pledge of SERO tokens, to ensure that these functions have a healthy flow of value for service and feedback, from both ends of the provision and usage.

Related news

Search news

Recommended news

The SERO Foundation officially invests in the RHINO Trading Platform

2020-04-26

SERO successfully passed the code audit of IT Security Firm KnownSec.com

2020-04-05

Announcement of Staff Change

2020-02-10

Introducing SERO 2.0- The Rise and Vision-Part 3

2020-03-20

Introducing SERO 2.0- The Rise and Vision-Part 2

2020-03-20

Introducing SERO 2.0- The Rise and Vision-Part 1

2020-03-20

SERO Tokenomics and Circulation Statistics (as of 2019.4.30)

2019-04-30

SERO Mainnet Launch : GPU Mining and New Algorithm

2019-05-31

SERO Guild Reward Pool Adjustment Plan Announcement and SERO Association

2019-04-25

SERO Mining Association Reward System

2019-01-23

SIP1 and BETANET-R5 Release

2019-01-23

SERO BETANET-Release is launched!

2019-01-08

SERO BETANET-RC1(v0.3.0-beta.1) Released

2018-11-21